To design consumer tool for holistic financial planning, I pioneered an intuitive visuospatial experience.

Financial planning is complex, difficult, and intimidating. Holistic planning which incorporates income, expenses, assets, debts, and financial goals is especially challenging for consumers. This type of planning is often handled by financial professionals; however, consumers are increasingly seeking and expecting digital tools to manage their own holistic financial planning.

Role: Lead UX Designer and Primary Inventor

Process: Strategic Research | Design Sprint | User Testing

Methods: Survey | Journal Study | Contextual Inquiry | Ethnographic Interviews | Creative Thinking Exercises | Analogue Prototyping | Digital Prototyping | User Testing

Solution: By disrupting industry standards whereby a financial plan consists of complex spreadsheets, my project team and I crafted an experience which empowers consumers to conduct holistic financial planning on their own behalf.

Project Background

This project was one part of a broad initiative by the third largest United States brokerage firm to overhaul their financial planning products. I was a designer and researcher staffed on numerous projects for this initiative.

Visuospatial financial planning , as a concept, arose from our efforts to reimagine the future of financial planning. This reimagining was intended to set strategic direction for continued improvement of existing products. This project strove to discover an intuitive translations of holistic financial planning for general consumers.

As a preliminary step towards the future of financial planning, our team and I needed to surmount biases from standard industry conventions. These biases stem from planning experiences that are derived from the an academic display of financial theory - an esoteric representation that bewilders general consumers.

To surmount such biases, I conducted strategic research that questioned our assumptions and established a future vision for holistic financial planning with user-centric roots.

Research Objectives

My strategic research consisted of a three part dscout study (survey, journal study, and contextual inquiry) that informed in-depth ethnographic interviews. These studies at a high level explored the following questions:

• What defines a plan?

• What Makes Planning Difficult?

• What does a plan provide you?

• How do you make a plan?

• What resources do you use?

• How is progress tracked?

• How do you know a plan is good?

dscout Study

dscout is a remote research tool that provides an exceptional starting point for research. Its in-context feedback paired with powerful analytics quickly bridged a gap in my understanding between the industry perspective on financial planning and our target users mental models. I split our dscout study into three parts over the course of three weeks:

1) Survey, as the first part, served to screen participants for our target users and explore their mental models for financial planning.

2) Journal Study, as the second part, revealed influences (good & bad) that shape our target user's mental models. To acheive this, we had participants maintain a journal of financial planning behavior over the course of a week.

3) Contextual Inquiry, as the third part, deepened our understanding of the specific tools and resources (digital & analog) our target users utalize for financial planning.

Ethnographic Study

With insights from dscout, I consulted an external (outside the company) research partner to develop an ethnographic study. This study consisted of in-person interviews within the homes of six participants from the dscout study. I selected these participants to represent a range of target users.

I captured notes during four interviews and facilitated two of them. Additionally, I supported my research partner in analyzing feedback from interviews into a final report.

These interviews provided direct observation of our target user’s financial planning processes. I developed a deep understanding behind their behavior and the tools/resources they use for holistic financial planning. Furthermore I was made aware of an inexact, complex networks of influences that target users utalize to reconcile uncertainty in their plan with their desire for stability from financial planning.

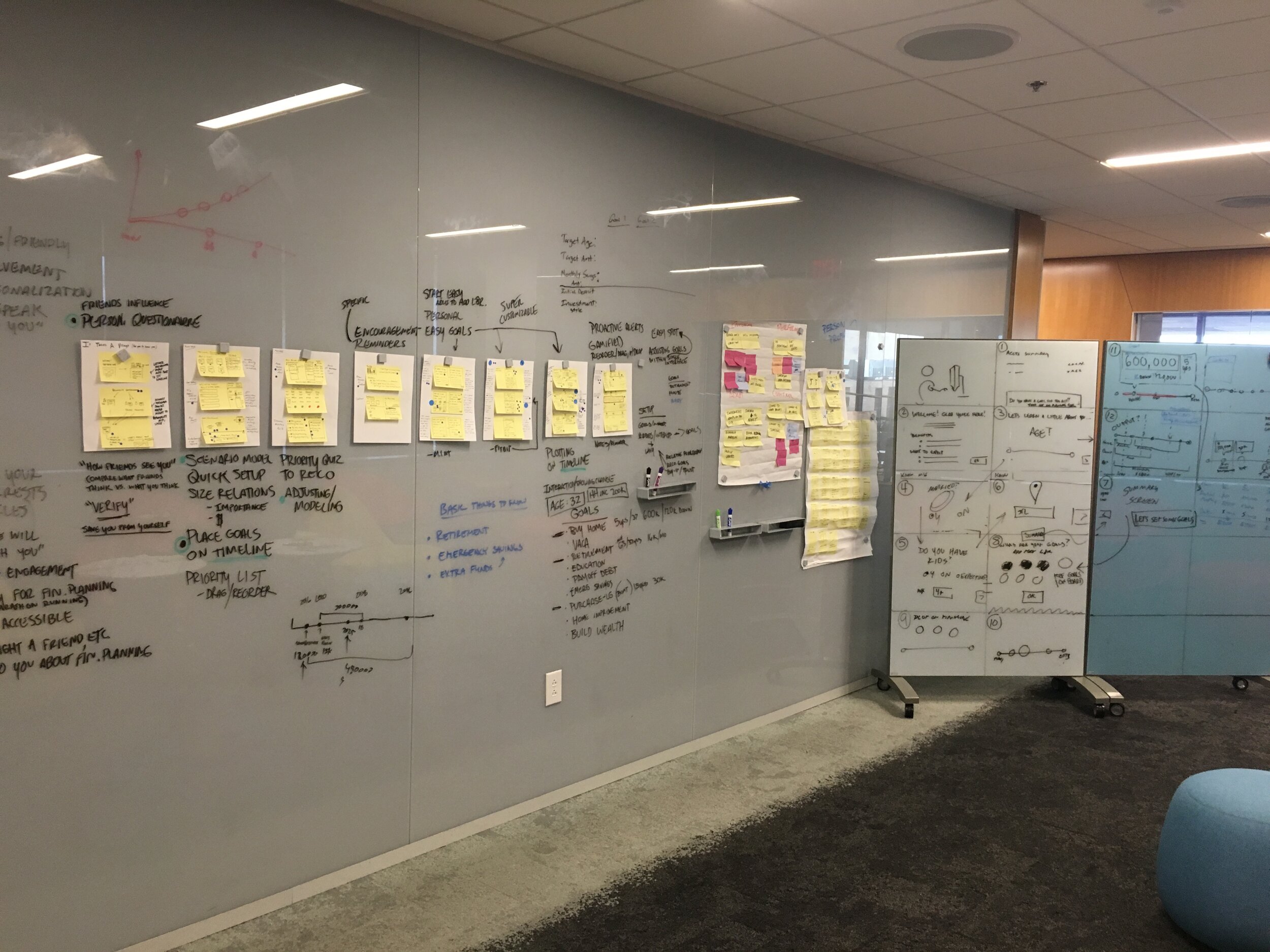

After my strategic research, the project team participated in three design sprints. Each sprint focused on a portion of the planning experience: onboarding, plan management, and progress tracking. Sprints consisted of 10 individuals with a 50/50 split between ‘creatives’, such as myself, and business stakeholders from the companies financial planning products.

Visuospatial financial planning, as a solution, developed from the design sprint focused was on on plan management. Plan management is a process whereby users changes and optimize their plan. For holistic financial planning, plan management often involves complex tradeoffs between numerous financial factors.

Visuospatial Concept

As a concept, visuospatial planning evolved from a talk by a financial advisor that I attended. This advisor described his process with clients and, as the advisor spoke, I had an epiphany. I realized that an effective digital planning experience, according to our research, was essentially a translation of this advisor conversations with his clients. This begged the questions of how effective advisors explain holistic planning to their clients and what language, metaphors, analogies, etc. do they use to match their client’s mental models? In fact, this realization of mine spurned another study that I with financial advisors following this project.

The advisor giving this talk, had developed a particular analogy for explaining holistic financial planning to his clients. This analogy described adjustments to a plan as the act of pulling levers for individual financial goals. If a clients plan couldn’t fit all their goals had to play with the levers to increase or decrease the size of individual goals until they could all fit in a plan. The two main factors that pushed the levers being goal cost and goal time. Using this analogy as inspiration during the project’s design sprint, I explored ways to similarly represent the act of managing a plan as adjusting the size of goals to fit together within a container that represented your plan - visuospatial financial planning.

Ultimately, my colleagues recognized this idea of mine as extremely valuable and our ideation converge on a visuospatial planning solution. However, before we fully pursued this concept through the develop phase of our design sprint. We had to overcome a major hurdle…

“Being exceptionally unique to any planning product throughout the industry, our primary stakeholder was hesitant and unwilling to explore visuospatial planning without evidence the concept could succeed. ”

Impromptu Concept Testing

Without user feedback, our primary stakeholder was concerned visuospatial planning would not resonate with users - even though it aligned to the findings of strategic research. And, he was not willing to risk our design sprint’s outcome on what he viewed as an educated guess.

To salvage any possibility for visuospatial planning, I constructed a means for testing the concept in under two hours!

We had little more than two hours before a deadline to establish design direction for the rest of the sprint. In the face of this deadline, I devised a way to solve our dilemma and get feedback indicating whether or not visuospatial planning as a concept resonates with our users and is intuitive. I realized that a visuospatial concept could easily be represented as an analogue prototype using ball0ons, a box, basic sketches of an interface, and pieces of paper cut into UI controls.

This analogue prototype allowed for minimal prompting and we could see how intuitive our basic concept for visuospatial planning was. Although we couldn’t get access to our specific target users, I was able to pull people randomly from the companies hallway and test with approximately 15 user proxies.

My quick, guerrilla-style testing was critical in assuring our project’s leadership of the creative direction arising through the design sprint. With feedback from this testing our primary stakeholder agreed to continue our exploration of visuospatial planning and break many long standing dogmas for financial planning that are misaligned to the mental models of our users.

I developed a research protocol and facilitated user testing on the final day of our design sprint.

Supporting Prototype Development

Throughout the design sprint as we refined our design of visuospatial planning, I consulted with stakeholders to outline concerns and questions that I used to establish a user testing discussion guide. Additionally, based on this discussion guide, I directed development of a digital prototype to reflect content, functionality, and workflow necessary for answering our research objectives.

User Testing Format

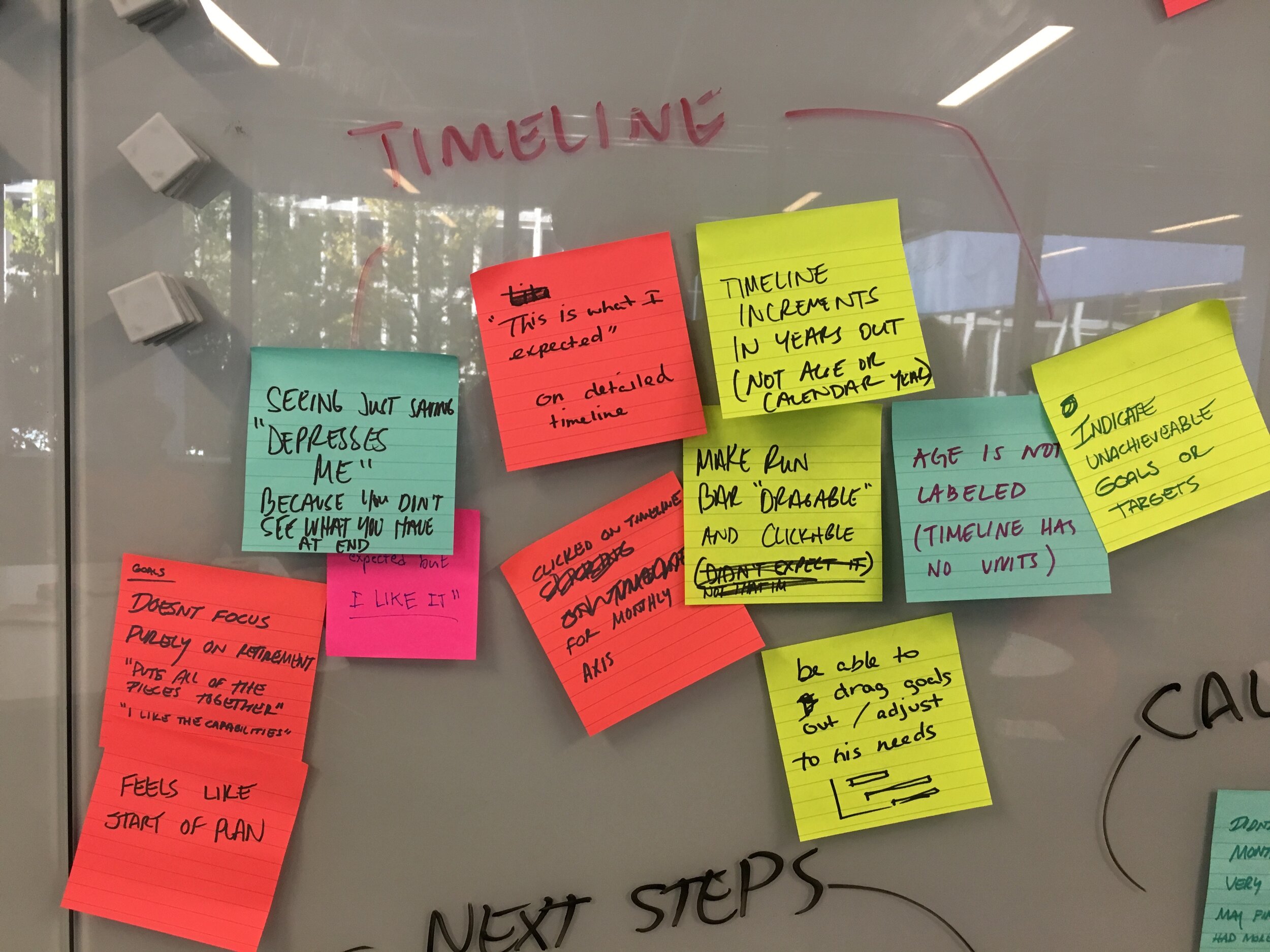

For user testing, I conducted six 45 minute usability tests with the same target users we interviewed for our ethnographic study. These tests were conducted remotely, but included screensharing software allowing participants to interact directly with our prototype. During the study, I had every member of our sprint team listen into the study and simultaneously perform a rose/thorn/bud exercise to outline the good (roses), the bad (thorns), and opportunities (buds) observed. This not only empowered our project to quickly act on high level findings, but it also engender deeper trust and understanding of the feedback received. This deep trust was especially critical for the ability for our project to deliver an impact when one considers the financial planning norms and standards that visuospatial planning disrupted.

At the end of the day, with all six usability tests completed, I led the team in an immediate debrief of our initial observations. Part of this process included affinity clustering of the team’s rose/thorn/bud output. Additionally, following the design sprint, I developed a formal report that was distributed to the project members as well as numerous stakeholders beyond the project.

Ultimately this project provided a revolutionary vision for the future development of financial planning products and helped guide updates to existing products. Furthermore, this project resulted in intellectual property (filed for patent) as a uniquely valuable departure from anything present across the financial industry’s competitive landscape.

With extensive resources dedicated to existing financial planning products, the brokerage firm this project was for could not simply scrap their current platform for an entirely new experience. However, the value in our project were not lost upon the company’s leadership who were present throughout our project as key stakeholders participating within design sprints.

As such, a great value realized in our project was in fostering collaboration between previously isolated groups within the company who all owned siloed pieces of what constitutes holistic financial planning. Prior to this project, these groups failed to connect themselves to a larger financial planning picture necessary for a holistic financial planning. This project spurned communication between these groups and has been the impetus for updates guiding the companies products towards an experience that captures the value of visuospatial planning.

With intellectual property, of which I’m the lead inventor for, the company gained a advantage to help them actively and defensively retain their prominent position within the industry as the third largest U.S. brokerage firm.