To improve regulatory documentation of client conversations, I designed a digital note-taking experience for financial advisors.

Brokerage firms struggle to effectively document their adherence to turbulent government regulations. This challenge is especially pronounced in their efforts to document conversations between their financial advisors and clients. Extracting, cataloguing, and evaluating pertinent regulatory information from these conversations is exceptionally cumbersome and imprecise.

Role: Lead Designer & Researcher

Process: Research |Ideate | Test Concepts | Iterate | Test Design

Methods: Contextual Inquiry | User Interviews | Stakeholder Mapping | Thumbnail Sketching| Visualize the Vote | Importance/Difficulty Matrix | Wireframing | Prototyping | User Testing

Solution: A digital note platform with regulatory catagorization and guidance features that automatically respond to natural note-taking behaviors of users. These features eliminate the cognative load of regulatory adherence and vastly reduces documentation error.

The digital note-taking experience I designed for this project was in service to the third largest brokerage firm in the united states. Before we began designing and developing a solution, I conducted background research to understand our problem space and the users who would use the product we ultimately designed.

Stakeholder Mapping

With numerous stakeholders interested in the details of client conversations, it was critical for myself and my team to understand these stakeholders and their influence regarding regulatory documentation. Using stakeholder mapping as an exercise, I identified two user-groups involved in the extraction and use of regulatory relevant information from client conversations:

• Financial Advisors who facilitate client conversations and document the conversation in their notes.

• Compliance Officers who are not involved in client conversations but rely on notes from financial advisors to audit regulatory adherence.

Ethnographic Interviews

To instruct initial design iterations, I studied the needs and behaviors of both user-groups (financial advisors and compliance officers) through ethnographic interviews. These interviews revealed a key distinction between our user-group’s that served as a foundational factor impacting the success of any solution. This distinction was in the motivation our user-groups had while documenting client conversations:

• Financial Advisors document client conversations to satisfy two objectives - address financial needs of clients and foster relationships of trust them. Documenting regulatory adherence is not a consideration for financial advisors.

• Compliance Officers, in contrast, are solely concerned with the documentation of specific information for regulatory audit.

Although financial advisors will often document information needed by compliance officers in their notes, this information is typically buried within a notes broader context and does not in itself match the prescriptive categorization required for regulatory documentation.

I defined an overarching design directive for the project using feedback from ethnographic interviews. This directive had myself and my team pursuing regulatory documentation features to a note-taking experience that were seemingly invisible to the financial advisor. We sought to create solutions that had nearly no impact to the cognitive-load of financial advisors and never supplanted, interfered, or impeded the documentation needs of financial advisors. If we did not succeed at this, we were confident that financial advisors would utilize an entirely different note-taking experience as a backlash. This understanding led us to focus on the following problem statement:

“How might we extract regulatory information from what financial advisors naturally document in client conversation notes?”

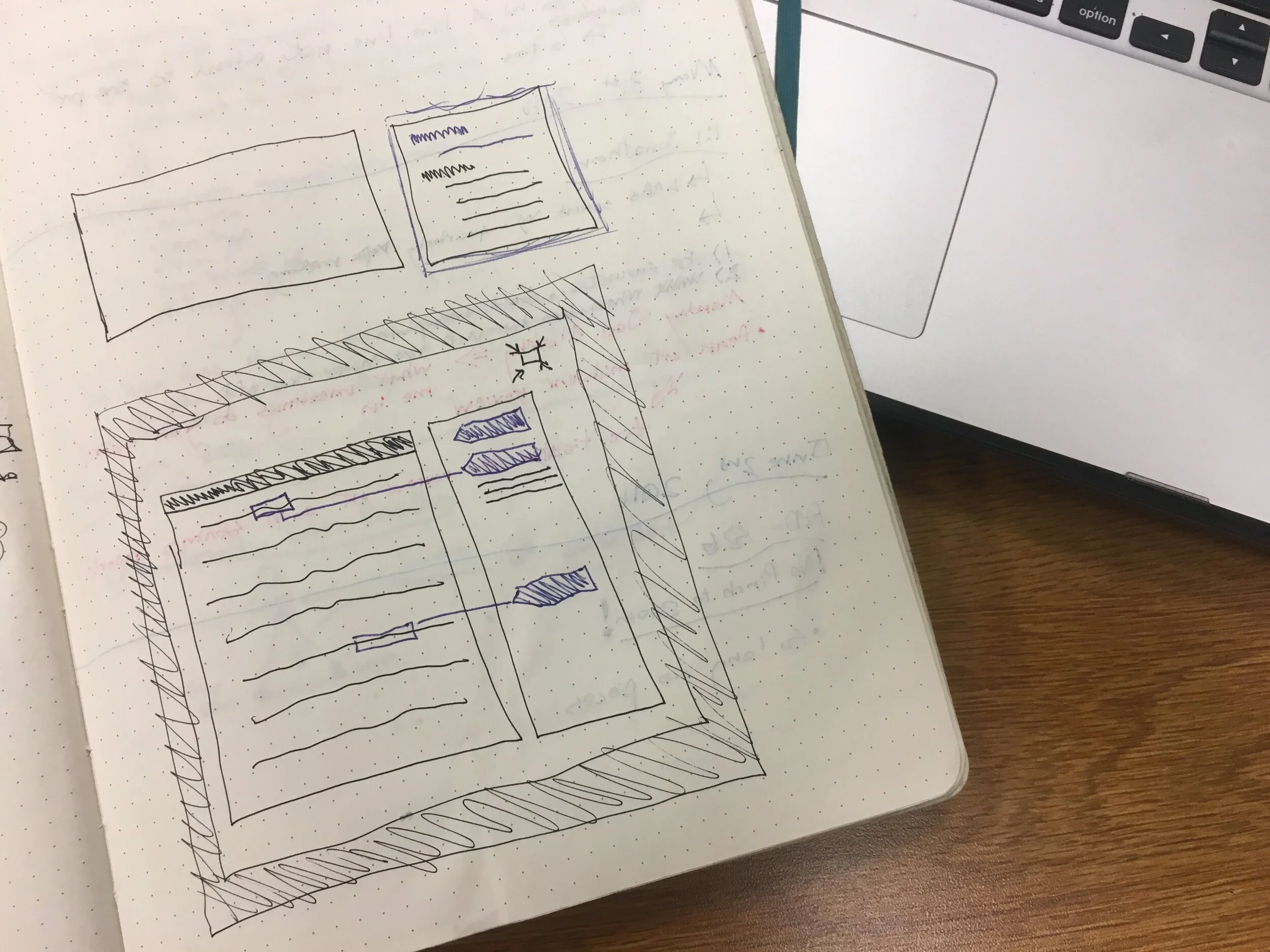

Thumbnail Sketching

To begin the ideation process, I facilitated a thumbnail sketching exercise with my project team. I encouraged everyone to sketch any and all ideas even if they were not ‘all-encompassing’ of a digital note experience. In fact, I requested sketches to remain as simple illustrations so that they ideas often related to one of potentially many considerations we were designing for.

In two 10-minute rounds we sketched our ideas on post-it notes. Between rounds everyone silently reviewed each other’s sketches to further creative thinking and ideation by confronting the unique perspective others brought to the challenge and seeking meaning in your own interpretation of their sketches.

Visualizing The Vote

To converge our ideation following thumbnail sketching, everyone voted on sketches they believed to be the most valuable in regards to our problem statement. If someones sketch received votes, they were given time to describe and clarify their idea. This process provided the project team with a deep understand of these ideas and often produced conversation that furthered the depth and reach of the initial idea.

Importance/Difficulty Matrix

In order for myself and my design partners to focus our initial design efforts, I guided the project team in a process to prioritize ideas we had brainstormed. Taking sketches that received votes during our ‘visualize the vote’ exercise, I asked the project team to place sketches along an x-axis relative to their value in addressing our problem statement and along a y-axis in accordance to their difficulty to achieve. With this importance/difficulty matrix, my design partners and I could prioritize our early design explorations.

I organized our early ideas into two different types of solutions using affinity clustering. To best assess the value of these different solutions and test a large number of early concepts with users, I produced two prototypes. Each prototype was focused towards one of these solution types we called ‘note-types.

Note Types Tested

• Structured Notes notes provide financial advisors with specific data entry fields to capture regulatory information.

• Unstructured Notes notes allow financial advisors to enter information however they like and require automated processes and unobtrusive asides to captured regulatory information.

We knew that the structured note-type appeared contrary to our goal in reducing regulatory related cognitive load for financial advisors; however, we theorized that a well designed process that was clear and direct could produce a frictionless flow that avoided confusion that we thought might arise from the automated behavior of many aspects of the unstructured note-type.

User Testing

When we tested low-fidelity prototypes of our two note-types with users the results surprised us. Financial advisors did not broadly prefer the unstructured note-type as we had predicted. However, not so surprisingly, the structured note-type was not preferred either. Instead, users consistently voiced and expressed a desire for a note blending structured and unstructured elements.

It was determined that a minimal use of structured elements actually empowered financial advisors with guidance and clarity that they found valuable regardless of any regulatory purpose.

The balance for integrating structured features into the note design hinged on the features ability to reduce a financial advisors need to self audit ‘best’ note-taking practices while avoiding any strict guidelines that prescribe if, how, and where information is documented in the note. If we overextended the integration of structured features into our design, we risked obscuring the broader context that financial advisors utilize client conversation notes for. This balance became understood through our user testing of the two note-types and empowered the team to continue iterations towards a note-type that blended structured and unstructured elements together.

“...users consistently voiced and expressed a desire for a note blending structured and unstructured elements.”

With clear feedback direction us towards an experience blending structured and unstructured elements, I iterated on a digital note with three main features for seamlessly supporting the need to document regulatory information from client conversations:

Tagging | Templates | Defaults

Tagging

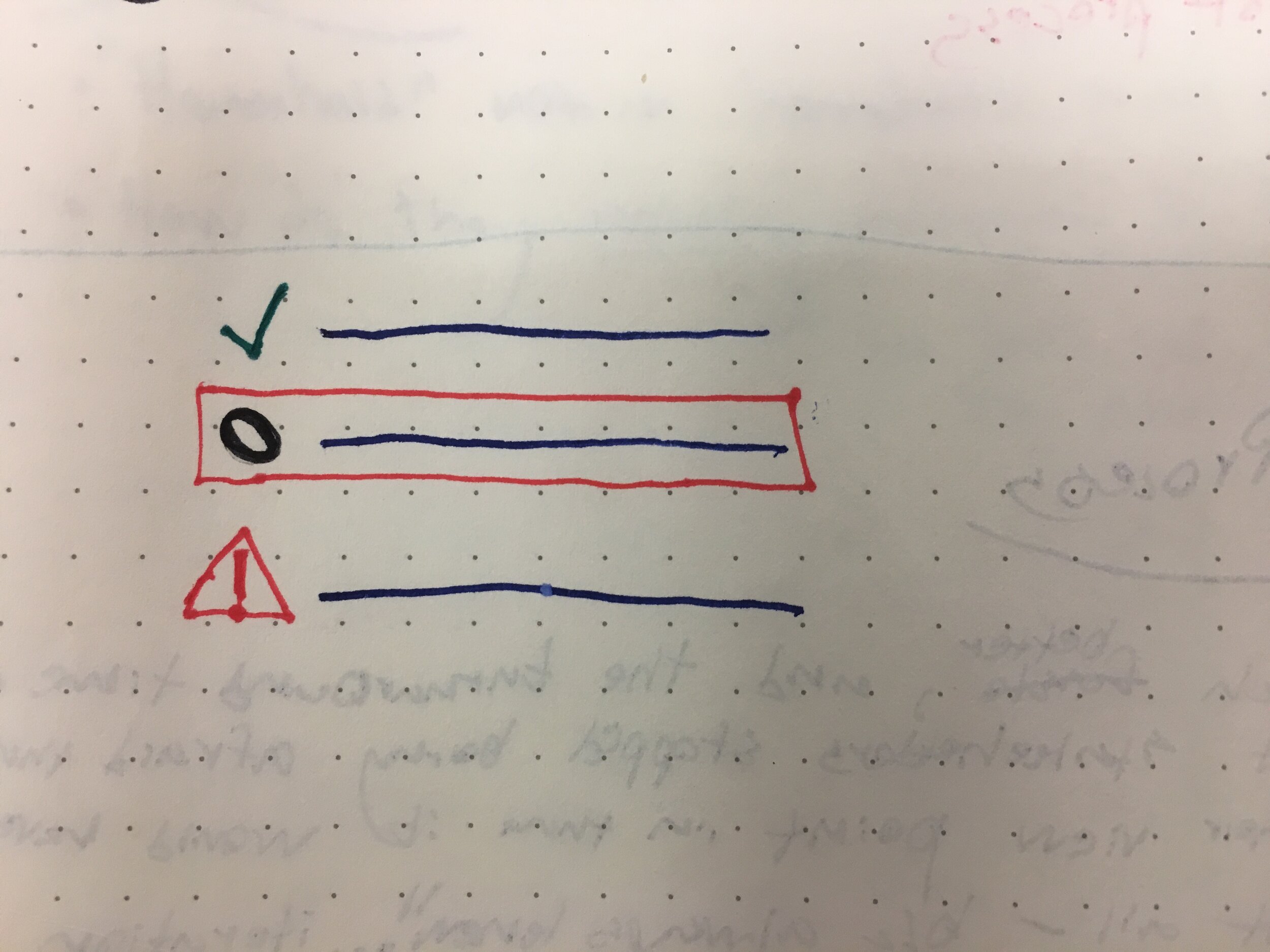

The tagging feature applies descriptive tags (structured) to notes based on the real-time analysis of a financial advisor’s input (unstructured). These tags are used by compliance officers to verify regulatory compliance while providing financial advisors with clarity surrounding the regulatory context of their client conversations. Tags are exceptionally powerful as they can shift in accordance to regulatory changes without requiring any change in the user behavior.

Templates

The templates feature provides financial advisors with guidelines they can follow (structured) when documenting a note on a client conversation. These guidelines do not limit the input (unstructured) of financial advisors and are in an unobtrusive location of the user interface. If desired, financial advisors can further structure their notes by directly importing the guidelines into their note or just as easily ignore the guidelines all together. Templates guide financial advisors towards satisfying regulatory needs and inform on the broader best practices for documenting client conversations.

Defaults

All structured elements within our design (such as radio button selections) include default selections when a new note is created. Defaults are intelligently determined from the context of a users workspace to reduce friction within the experience. With defaults, we could catalogue regulatory information in a rigorous fashion without imposing the workload of such categorization on financial advisors.

To evaluate our design, I created a highly interactive, dynamic prototype and used it to conduct usability tests with financial advisors as our users.

Research Protocol

I wrote the discussion guide and research protocol for this usability study with a focus on answering four key questions:

1) Is the experience intuitive for financial advisors?

2) Do financial advisors value in how we designed the features of tagging, templates, and defaults?

3) Would financial advisors resist adopting this experience over their current note process?

4) Do financial advisors compromise the integrity of regulatory documentation in how they use the experience?

I sought feedback from our study participants that not only answered our key questions but also delved into the why and/or how behind their responses. . Ultimately, this usability study validated our primary design decisions; however, the feedback revealed opportunities for improvement that, in accordance to, we made adjustments in our final design.

The digital note experience my team created was implemented for 15,000 financial advisors. Additionally, this experience was one of the first updates delivered to a next-generation digital platform myself and others were building for the brokerage firm third largest brokerage firm in the United States.

Following the release of this experience, we saw an increase in the number of digital notes being captured by financial advisors. This uptick suggested that financial advisors who were previously utilizing analogue means for documenting client conversations were now using our digital note. As a result, the brokerage firm had substantially reduced their exposure to regulatory risk and we received extensive praise from the companies legal counsels.